OK Sales Tax Rebate - Tulsa free printable template

Show details

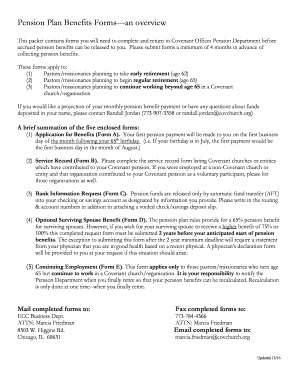

I and my dependents if any have lived inside Tulsa City limits for at least one year prior to this application. I contributed the greatest share of the family income. I cannot be claimed as a member of the household on another resident s application. OR 1. I meet the eligibility criteria for the Oklahoma Sales Tax Relief Act pursuant to 68 O. Please mail form to City of Tulsa Attn Sales Tax Rebate P. O Box 1499 Tulsa OK 74101-1499 Application for Fix Our Streets Sales Tax Rebate or drop off...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OK Sales Tax Rebate - Tulsa

Edit your OK Sales Tax Rebate - Tulsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OK Sales Tax Rebate - Tulsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit OK Sales Tax Rebate - Tulsa online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit OK Sales Tax Rebate - Tulsa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out OK Sales Tax Rebate - Tulsa

How to fill out OK Sales Tax Rebate - Tulsa City

01

Download the OK Sales Tax Rebate form from the Tulsa City website.

02

Fill in your personal information including name, address, and contact details.

03

Provide details of the purchases made that qualify for the sales tax rebate, including dates and amounts.

04

Attach copies of receipts or proof of purchase for the items listed.

05

Add any additional required documentation, such as proof of residence or tax identification.

06

Check the form for accuracy and completeness.

07

Submit the completed form and attached documents to the designated office in Tulsa City, either in person or via mail.

Who needs OK Sales Tax Rebate - Tulsa City?

01

Residents of Tulsa City who have made qualifying purchases and paid sales tax.

02

Business owners who have incurred sales tax on eligible business-related purchases.

03

Individuals seeking to recover a portion of sales tax paid for goods and services.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1099 form for taxes?

The IRS 1099 Form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn't your employer. The payer fills out the form with the appropriate details and sends copies to you and the IRS, reporting payments made during the tax year.

What is the W 7 tax form?

Use Form W-7 to apply for an IRS individual taxpayer identification number (ITIN). You can also use this form to renew an existing ITIN that is expiring or that has already expired.

What is the difference between a w9 and a SS-4?

Form W-9, which requests the taxpayer identification number of a taxpayer, is different from Form SS-4. While W-9 can seek certification of an EIN, Form SS-4 is used to actually apply for an EIN.

Is a 1040 the same as a w2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

Is W9 or W4 better?

When comparing the W-4 vs W-9 forms, the difference is that an employee fills out a W-4 while an independent contractor fills out a W-9. You may elect for Toast to generate forms 1099-NEC which will be shipped directly to contractors. Otherwise, the contractor will be responsible for their own tax filings.

What is SS-4 form used for?

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete OK Sales Tax Rebate - Tulsa online?

pdfFiller has made filling out and eSigning OK Sales Tax Rebate - Tulsa easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an eSignature for the OK Sales Tax Rebate - Tulsa in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your OK Sales Tax Rebate - Tulsa and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out the OK Sales Tax Rebate - Tulsa form on my smartphone?

Use the pdfFiller mobile app to fill out and sign OK Sales Tax Rebate - Tulsa. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is OK Sales Tax Rebate - Tulsa City?

The OK Sales Tax Rebate is a program in Tulsa City that allows eligible businesses to receive a refund on a portion of the sales tax they have collected and remitted to the city.

Who is required to file OK Sales Tax Rebate - Tulsa City?

Businesses that have remitted sales tax to the City of Tulsa and meet the eligibility criteria set by the program are required to file for the OK Sales Tax Rebate.

How to fill out OK Sales Tax Rebate - Tulsa City?

To fill out the OK Sales Tax Rebate, businesses must complete the designated rebate application form, provide supporting documentation, and submit it to the appropriate city department as outlined in the program guidelines.

What is the purpose of OK Sales Tax Rebate - Tulsa City?

The purpose of the OK Sales Tax Rebate is to incentivize businesses to remain in or move to Tulsa City by reducing their overall tax burden and encouraging economic growth.

What information must be reported on OK Sales Tax Rebate - Tulsa City?

Businesses must report details including the amount of sales tax collected, the time frame of the sales, business identification information, and any other specific data requested by the rebate application.

Fill out your OK Sales Tax Rebate - Tulsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OK Sales Tax Rebate - Tulsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.